Summary

Given Weatherford’s declining EBITDA and high debt load, liquidation value may be a better metric.

I believe Weatherford’s inventory ($1.1B), PP&E ($5.7B), intangibles and non-current assets ($3.5B) are higher than their liquidation value.

Even with its $565 million equity raise, based on liquidation value Weatherford is insolvent.

WFT remains a great short play.

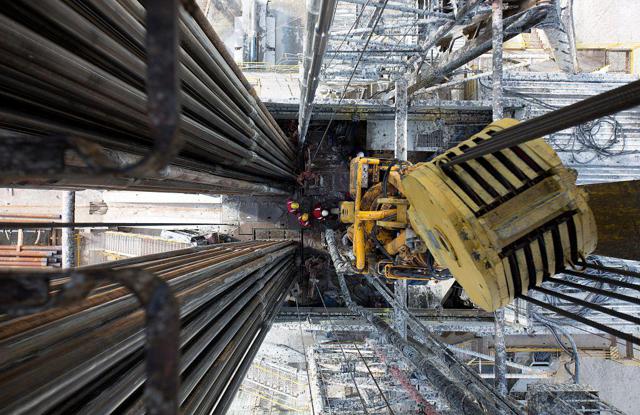

Source: Fortune

Earlier this week Weatherford International (NYSE:WFT) completed a capital raise of 100 million shares at about $5.65 per share. The $565 million capital injection could help alleviate liquidity strain or make its $350 million principal payment that was due last month. Nonetheless, the company’s deb…

Read the full article at: http://seekingalpha.com/article/3956152-based-liquidation-value-weatherford-insolvent