Australian banks, already facing a drag from the coronavirus pandemic, may see renewed pressure on their earnings after the reemergence of the disease led to fresh lockdowns in parts of the nation in August.

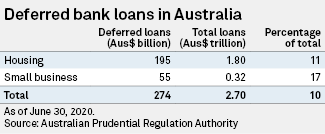

At the heart of the uncertainty facing Australia’s banking sector is the loan deferrals extended to customers during the pandemic lockdown. Analysts are concerned that the major banks could see an increase in bad debt once the government’s support measures, including cash payments to households, are removed.

“There remains a substantial degree of uncertainty with respect to economy, the virus and the consumer. This is far from avoidable for the banking sector, whose business sits at the heart of the economy and cannot escape the …

Read the full article at: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/deferred-loans-may-push-australian-bad-debt-pile-higher-after-virus-relief-ends-60184238