Contents

- 1 Company and personal details

- 2 Company asset summary

- 3 Liabilities

- 4 Books and records

- 5 Insolvency checklist - A snapshot

- 6 Company details

- 7 Company asset summary

- 8 Liabilities

- 9 Books & records

- 10 Things to remember when preparing for company liquidation

- 11 Winding up and investigations

- 12 Zero Contact Liquidation: Preparing for company liquidation made simpler

If your company has become insolvent as a result of Coronavirus, you will find that preparing for company liquidation can be a stressful aspect of the process. Providing company details and other information related to your insolvency is important to allow liquidators, and the Australian Securities and Investments Commission (ASIC), to wind things up.

Whether your business is entering into a Creditors’ Voluntary Liquidation (CVL), Members’ Voluntary Liquidation (MVL) or court liquidation, a company director is required to provide all the information necessary for a registered liquidator to perform their duty of brining an insolvent company’s affairs to an end. Such a duty involves:

- Securing and realising all company assets;

- Making recoveries;

- Distributing resources to creditors;

- Conducting investigations into financial affairs;

- Distributing to creditors;

- Deregistering the company; and

- Keeping creditors and ASIC informed of their actions during the liquidation process.

In order to carry out these tasks and fully liquidate an insolvent company, insolvency accountants often work from an insolvency checklist which ticks off what information is necessary during company liquidation in order to ensure the process runs as smooth as possible.

Company and personal details

Providing a liquidator with company details may seem like an obvious and simple step but it is vital nonetheless. It is not unusual for a liquidation process to be delayed or run into issues further down the line because a company director withheld basic details or passed them on incorrectly. For example, a misspelt email address or incorrect phone number will cause communication issues between you and the liquidator and may affect your ability to see important documents submitted within their deadlines.

Incorrect company details may also cause administrative delays with ASIC or, in a worst-case scenario, cause ASIC and liquidators to suspect you are intentionally delaying the liquidation process in order to continue trading, which is against the law.

At the beginning of the company liquidation process, have your company’s ACN within reach, and ensure all details like email, phone number and postal address are correct and up to date.

Company asset summary

Company assets are one of the key elements required for paying creditors when an insolvent company goes into liquidation. The liquidator must have an understanding of what cash is available, and what company resources can be sold off in order to satisfy creditors’ outstanding debts.

When preparing for company liquidation you must also provide accurate details of the bank accounts associated with your company. A liquidator will need to know the status of the accounts (whether they are open or closed), who are the signatories on the accounts and any relevant statements.

You must also be able to report on debtor activity. Liquidators will require a run-down of outstanding debts, your accounts receivable ledger and will also want to get a sense of how your company prepared invoices.

It is also important to gather all details and records on the following company assets for liquidators to review:

- Director loans;

- Price to earnings ratios;

- Land;

- Company vehicles;

- Stock;

- Cash in bank and on hand; and

- Inventory.

Companies entered external administration across Australia 2019-20

New South Wales

Victoria

Queensland

Western Australia

South Australia

ACT

Northern Territory

Tasmania

Australian insolvency statistics, released September 2020 by the Australian Securities and Investments Commission.

Liabilities

Liquidators will need to get an understanding of your company’s liabilities and the amounts at the time of insolvency. Liabilities may include tax debts and anything that involves company employees, like wages, superannuation, annual leave and other financial entitlements.

It is also important to identify your creditors, both secured and unsecured. Unsecured creditors are creditors who do not have a security interest over your company’s assets, while secured creditors may hold a ‘security interest’ like land or a mortgage over a company asset.

Books and records

Whether they are electronic or stored in a filing cabinet, the following are good examples of the books and records you should keep, and what a liquidator may request during the company liquidation process:

- Financial statements like profit and loss statements, balance sheets and tax returns;

- Cash records like receipts, petty cash books and bank deposit records;

- Received or unpaid invoices;

- Company deeds;

- Bank statements and loan documents;

- Books of prime entry; and

- Working papers and other financial documents.

Despite the rise of digital insolvency services, which began with the introduction of like the 100% contact-free Zero Contact Liquidation provided by Insolvency Advisory Accountants. However it is still recommended that all electronic books and records at least have the ability to convert into hard copy should electronic issues arise during company liquidation.

It is also important to remember that a company officeholder is responsible for providing books and records, even if they are held by an accountant or registered agent.

Insolvency checklist - A snapshot

Liquidators will no doubt make their own inquiries and may require further information, but having these details close by can help expedite the company liquidation process and avoid unwanted stress.

Company details

- Trading company name

- ACN

- Best contact telephone

- Company or preferred email

- Company postal address

Company asset summary

- Director loans

- Price to earnings ratios

- Land

- Company vehicles

- Stock

- Cash in bank and on hand

- Inventory

Liabilities

- Secured & unsecured creditors

- Tax debt

- Wages

- Superannuation

- Employee entitlements

Books & records

- Financial statements

- Cash records

- Received or unpaid invoices

- Bank statements and loan documents

- Books of prime entry

- Working papers and other financial documents

Things to remember when preparing for company liquidation

Obtaining the information needed for the company liquidation process may vary depending on the liquidator or insolvency accounting firm, but here some questions you should be prepared to answer.

Director’s obligations

Company directors have a number of duties and obligations that they must adhere to as outlined in the Corporations Act 2001 (Cth). When preparing for company liquidation, it is important to understand a directors’ obligation to assist a liquidator during the company liquidation process in the following ways:

- Advising of the location of company property in their possession and delivering any such property to the liquidator;

- Avoiding obstruction of a liquidator’s duties;

- Providing all company books and records to the liquidator;

- Advising the liquidator of the whereabouts of other company records;

- Providing a Report On Company Activities and Property, or ROCAP, which details the company’s business, property and financial circumstances. During voluntary liquidation, you must provide a ROCAP within seven days of the appointment of a liquidator, or 14 days for a court liquidation; and

- Meeting with, or reporting to, the liquidator to help them with their enquiries, as reasonably required.

Hold on to business records

Section 286 of the Corporations Act 2001 (Cth) states that as part of their duties under law, company directors are required to keep financial records for at least seven years. That seven years begins after the transaction covered by the records was completed. It is vital not to throw anything out even if you think it might not be of any value to you – a liquidator will need it to help their insolvency investigation and the winding up process.

Winding up and investigations

Part of the company liquidation process includes a registered liquidator making investigations into an insolvent company’s financial situation. Not only does it provide the context and framework to determine the best course of action for the company, but it also shines a light on any questionable financial decisions, breaches of director duties or potential illegal activity that could have led to insolvency.

If your company is preparing for company liquidation, you will need to be ready with suitable responses for questions like:

- What is the business of the company?

- Is the business still trading? If not, when did it cease?

- Are you carrying on a similar business or otherwise employed?

- Is the business of the company carrying on under another entity or in your personal capacity?

- Where did the company operate from?

- What was your role in management of the company?

- Any other people involved in the day-to-day management of the company?

- Reason for insolvency / liquidation?

- When did you realise the Company may be insolvent?

REMEMBER: Providing misleading or blatantly false information during the company liquidation investigation can lead to irreversible business reputation damage and serious legal penalties.

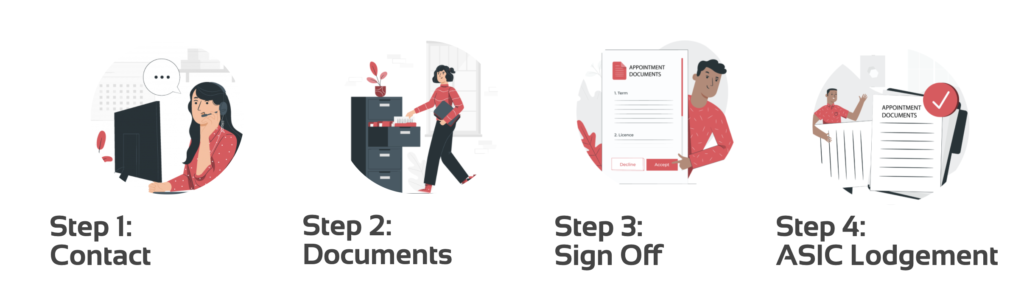

Zero Contact Liquidation: Preparing for company liquidation made simpler

If your company has fallen on hard times, whether it be due to the financial strain of Coronavirus or an unrelated situation, it is vital to take immediate action. The best first step is to review our insolvency indicators and then become familiar with the Insolvency Advisory Accountants insolvency checklist.

Taking immediate action when insolvent is vital, as companies that continue to trade and incur new liabilities, even though they cannot pay new and existing debts, face the legal ramifications of insolvent trading.

Fortunately, there is help available to deal with the stress of dealing with insolvency and preparing for company liquidation. With one phone call or a push of a button, you can get in touch with Insolvency Advisory Accountants who will work with you to determine the best company dissolution service to suit your company’s financial circumstances. Insolvency Advisory Accountants offers liquidation packages that are extremely affordable, meaning you won’t have to worry about additional heavy expense during an already difficult time.

More importantly, Insolvency Advisory Accountants provides the game-changing Zero Contact Liquidation service during COVID-19 restrictions, allowing you to work with us and handle the situation in your own comfort. Our zero-contact process starts with an obligation-free consultation to discuss your situation and your options. Once we understand what you need, we supply you with the documents required to get the process underway. All forms are populated with your information and then approved and signed 100 per cent electronically, allowing you the chance to avoid added travel or administrative hassle.

Once all documentation is complete, we lodge them with ASIC. The biggest lesson we have learned from decades of industry experience is that insolvency can be extremely stressful. And with COVID-19 adding greater strain on your lifestyle, we have never been more motivated to provide Zero Contact Liquidation solutions so you can deal with your situation in any location you feel the most comfortable.

To find out more about your options, contact the experts at Insolvency Guardian.