Defunct buy now pay later business Openpay was put into voluntary liquidation late last week after attempts to sell or recapitalise the business failed.

Openpay collapsed into receivership in February this year owing more than $66.1 million to creditors, $4.1 million in unpaid leave and wages to employees, and with just $1.2 million left as cash in the bank, according to reports.

It is unclear whether retailers had been fully paid for transactions over the Openpay platform at the time of its collapse.

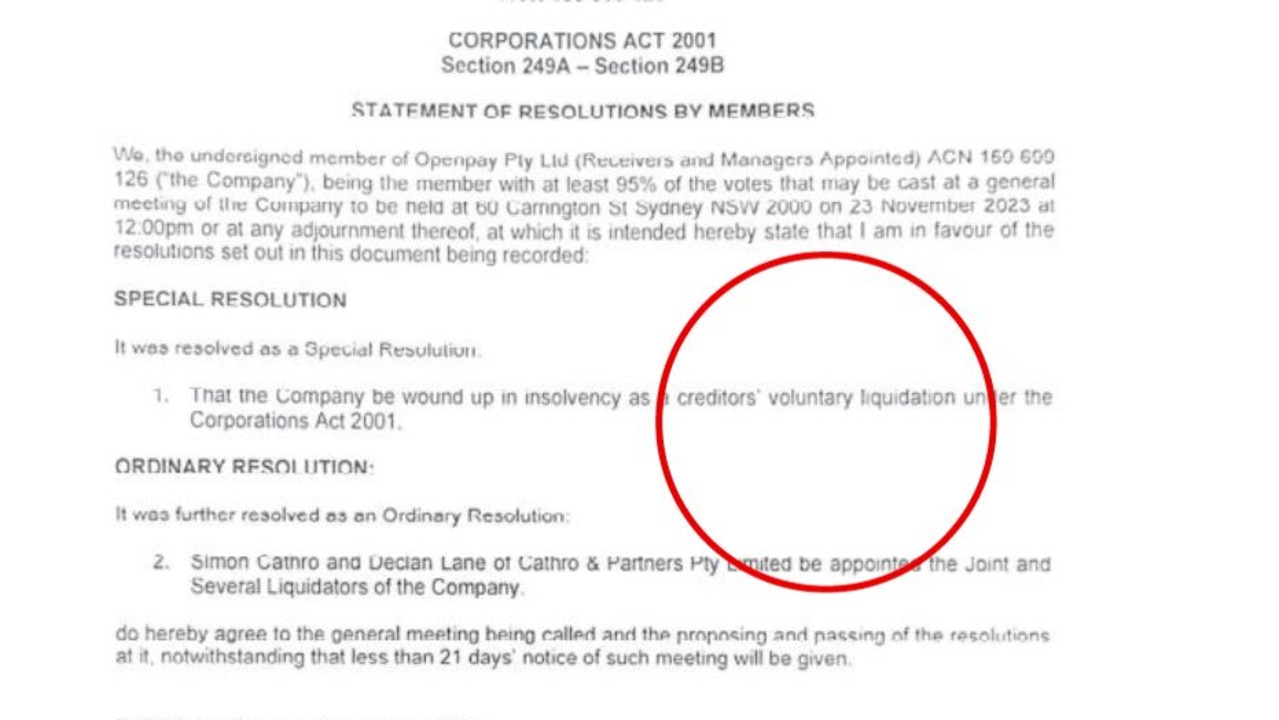

On Thursday, Simon Cathro and Declan Lane of Cathro & Partners were appointed as liquidators and administrators to oversee the winding up of Openpay, according to documents filed with the Australian Securities and Investments Commission (AS…

Read the full article at: https://www.thechronicle.com.au/business/companies/retail/buy-now-pay-later-business-openpay-in-liquidation-following-collapse/news-story/131bf0122ea230cb889a71538a102114?nk=dde802ea9ac98466d5afe9c13709a3db-1701252049