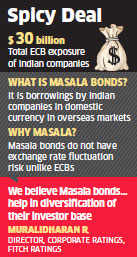

MUMBAI: A number of infrastructure companies, including some major private players, are looking to sell masala bonds, as they seek to reduce the risks associated with external commercial borrowings by moving to this rupee-denominated overseas debt that also comes with easier conditions.

As much as $6 billion (about Rs 40,000 crore) could be raised through masala bonds in the coming few months by Indian businesses, say industry trackers. Companies such as SREI Infrastructure Finance, GVK and GMR are some of the private infrastructure players that could be exploring the scope for raising funds through this route, people with knowledge of the plans said. Besides other benefits, the cost of borrowing could also be lower in masala bonds compar…

Read the full article at: http://economictimes.indiatimes.com/markets/bonds/re-denominated-overseas-debt-to-help-companies-avoid-currency-risks-6-billion-expected-to-be-raised-soon/articleshow/49989555.cms