Andrii Yalanskyi

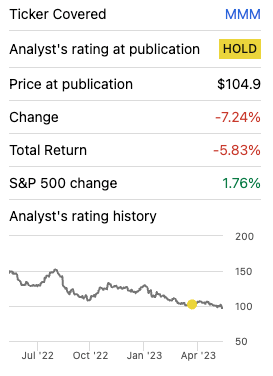

In my last article, I valued 3M (NYSE:MMM) shares at $99 and recommended staying away till we have more details on the risks regarding the litigations. Since then, the stock price has declined below my target valuation.

Seeking Alpha

Since that article, the company has released Q1 2023 earnings and announced restructuring ahead of the healthcare spinout. In this article, I will briefly summarize the earning release, double-click on the restructuring and refresh the valuation.

Q1 earnings

On April 25, 3M released its earnings report for the first quarter of 2023. Revenues decreased by 9.7% and EPS decreased by 25.7%, however, the decrease was lower than the street expectation. While the figures showed a decline …

Read the full article at: https://seekingalpha.com/article/4607868-restructuring-3m-is-likely-not-sufficient-to-offset-litigations?source=feed_all_articles