Company liquidation is a complex process made up of administrative requirements and legal obligations, meaning that it can take an emotional toll on even the most stoic directors and business owners. It is why, when it comes time to winding up an insolvent business, getting the company liquidation advice is vital.

Seeking the right company liquidation advice has become an even more important as the crushing economic effects of Coronavirus continue to sweep the globe. Isolation, social distancing and customer restrictions have plagued business activity, cashflow and profits, and many owners and directors have faced tough decisions about their business’ longevity.

Is your business facing Coronavirus company liquidation? Don’t worry, you are not alone.

The most recent data on the impacts of COVID-19, according to the Australian Bureau of Statistics, shows that insolvency has become an inescapable reality for a growing number of businesses.

Did you know?

According to the ABS, the largest changes in payroll jobs occurred in accommodation and food services, which decreased by 17.9%, and arts and recreation services which decreased by 15.1%. Total wages decreased the most in mining by 19.9% and the accommodation and food services industry by 14.5%.

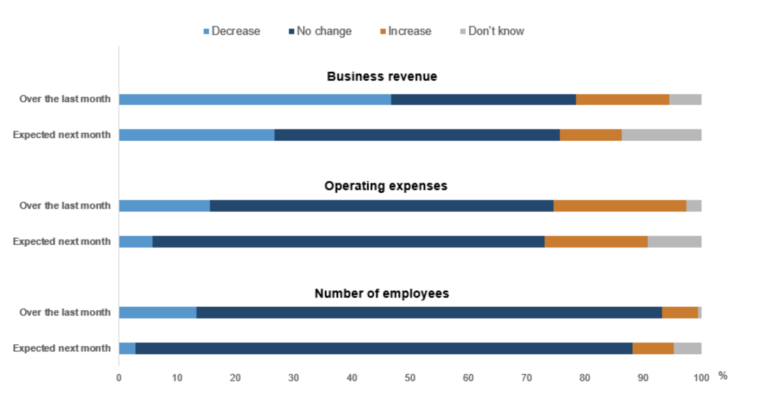

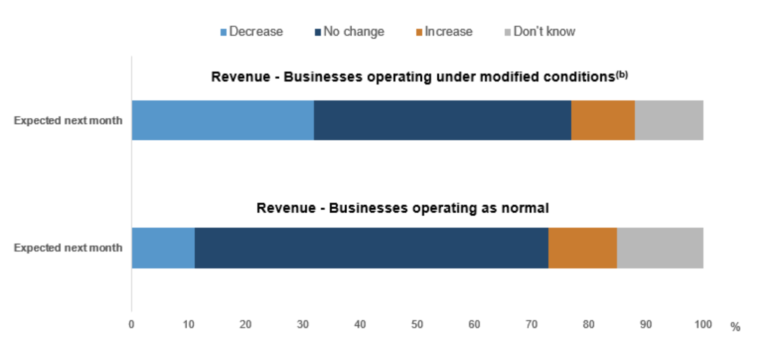

As of July 2020, 47 per cent of Australian businesses reported a decrease in revenue, while almost 30 per cent of businesses expected revenue to continue to decrease in the coming months. Even businesses that have been operating under modified conditions since the introduction of COVID-19 restrictions, which may include reduced staff or different in-store policies and businesses hours, are almost three times as likely to see a decrease in revenue compared to businesses operating as normal.

The ABS also reported that two in five businesses, or 42 per cent, have accessed wage subsidies, deferred loan repayments or have renegotiating rent or lease arrangements to stay afloat. However, businesses support measures like these were introduced by the Australian Government as temporary relief; they never meant to be permanent, and when they cease to be available, ten per cent of all businesses expect to close down.

Other businesses expected that once support measures disappear, they would resort to increasing prices, deferring or cancelling investment plans, or increasing their debt by seeking additional funds. And while these measures do not necessarily guarantee a business’ death knell, they may cause greater risk to long term solvency and survival.

To insolvency experts like us, these outlooks suggest that more businesses in the future will need to ensure they get the right company liquidation advice.

But why is getting the right company liquidation advice when insolvent so important?

Liquidators are experienced…and qualified

Liquidation carries with it a number of legal obligations and must be carried out by a liquidator who is registered under the Corporations Act 2001 (Cth). This means that seeking company liquidation advice involves more than sitting down with the family accountant.

Certified liquidators are allocated a ‘Registered Liquidator Number’ and their name and number appear on a special register held by the Australian Securities and Investment Commission (ASIC). This shows that they are, by law, able to wind up an insolvent company. Doing so is a big task with a number of significant responsibilities. ASIC states that “registered liquidators act in a fiduciary capacity, and often have total management control of the affairs, money and other property of a body corporate”.

Registered liquidators are thoroughly vetted before they earn their certification. An applicant is referred to an ASIC committee and then must undergo an interview and sometimes even sit an exam. An applicant can only then be registered after the committee decides they have all the necessary qualifications, knowledge and abilities, as well as a suitable amount of experience.

Ultimately, this is the long way of saying liquidators are experienced, and specialised, financial professionals who have been legally approved to handle company liquidations.

Quality company liquidation advice helps prevent illegal activity

Good liquidators will help you navigate through your legal obligations during insolvency and the company liquidation process. Insolvency can be a minefield, and there are numerous legal ramifications when the requirements set out in the Corporations Act 2001 (Cth) are not adhered to.

For example, under the Corporations Act 2001 (Cth), directors are duty-bound to prevent insolvent trading.

What is insolvent trading?

‘Insolvent trading’ or ‘trading while insolvent’ occurs when a company continues to trade and incur new liabilities, even though it is unable to pay its debts as and when they fall due. Insolvent trading can result in civil penalties of up to $200,000 or even criminal charges like imprisonment for up to five years.

Under the Act, directors can be found to have breached their duty to prevent insolvent trading if:

- A person is a director at the time a company incurs a debt;

- The company is insolvent at the time of incurring the debt or becomes insolvent because of incurring the debt;

- At the time the debt was incurred, there were reasonable grounds to suspect that the company was insolvent;

- The director was aware such grounds for suspicion existed; and

- A reasonable person in a like position would have been so aware.

But what about the Coronavirus safe harbour?

In the wake of economic struggle as a result of Coronavirus the Australian Government introduced a new section into the Corporations Act 2001 (Cth) (588GAAA) that would temporarily protect company directors from personal liability for insolvent trading. The safe harbour would allow insolvent businesses to continue operating and incur debts in the ordinary course of operations, without the fear of being punished for insolvent trading during the pandemic. The safe harbour’s aim was to grant struggling businesses more breathing room to regain their previous activity and cashflows.

However, that safe harbour was introduced in March 2020 and was only meant to be a temporary measure for six months. Directors should be aware that the government’s reprieve was introduced during a global pandemic and is therefore unlikely to be a permanent fixture in the Corporations Act 2001 (Cth), so seeking company liquidation advice is vital to prevent insolvent trading.

Poor (or no) advice during insolvency may also lead to illegal phoenix activity.

What is illegal phoenix activity?

Illegal phoenix activity is usually where a new company is created to continue the business of an existing company that has been deliberately liquidated or abandoned to avoid paying outstanding debts, including taxes, creditors and employee entitlements.

In the midst of financial strain due to business restrictions as a result of Coronavirus, we understand that some directors may resort to desperate measures to keep their business afloat. However, if those measures result in illegal phoenix activity, you can be implicated in breaches of directors’ duties, fraudulent concealment or removal of assets and fraud by company officers under the Corporations Act 2001 (Cth). That is why good company liquidation advice is needed, in order to avoid penalties such as large fines or even imprisonment for up to 15 years.

Insolvency Advisory Accountants can provide the company liquidation advice you need

Whether you are looking to place your business into voluntary administration or company liquidation, or you have just been declared insolvent, Insolvency Advisory Accountants is available to provide high quality support during the insolvency journey.

We have also changed the company liquidation game forever by introducing Zero Contact Liquidation. Our zero contact process starts with an obligation-free consultation to discuss your situation and your options. Once we understand what you need, we supply you with the documents required to get the process underway. All forms are populated with your information and then approved and signed 100 per cent electronically, allowing you the chance to avoid added travel or administrative hassle.

Once all documentation is complete, we lodge them with ASIC. The biggest lesson we have learned from decades of experience is that insolvency can be extremely stressful. And with COVID-19 adding greater strain on your lifestyle, we have never been more motivated to provide Zero Contact Liquidation solutions so you can deal with your situation wherever you feel the most at ease.